Market Minute- Full Report: August 2025

Equity Markets August carried forward the strong second-quarter results, with the Russell 3000 up nearly 11% in Q2, driven by technology (+23.5%), communication services (+19%), and industrials (+13.6%). Market gains remained concentrated in a few names—NVIDIA,...

Market Minute – What’s Bad is Good

By: Andrew B. Noto It feels like bad news has been good news to investors lately. We opened the month of October last week with two consecutive days of positive returns. Monday’s catalyst was investors thinking the Federal Open Market Committee’s (FOMC) tightening...

Market Minute – Inflation Report Shocks Investors

By: Andrew B. Noto Today started with news that the August consumer price index (CPI) report came in higher than expected and ended with aggressive selling in most major equity markets. When the trading day concluded, all thirty companies in the Dow Jones Industrial...

Market Minute – Some Minor Anguish in August

By: Andrew B. Noto With the closing bell this afternoon, the S&P 500, Dow Jones Industrial Average, and Russell 3000 indices all ended the month in negative territory after a roaring start. Halfway through the month, it looked like we were on track for another...

Not What We Hoped But Not Different Than Expected

By: Ralph C. Freibert III, Chief Investment Officer Last week’s CPI release was a bit of a disappointment. Almost 1-percent month-over-month (MoM), and 8.58-percent year-over-year (YoY). Economists were hoping for signs that inflation had peaked back in March at...

The Trend is Our Friend

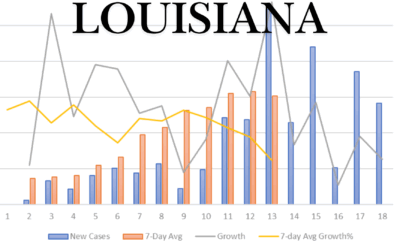

For weeks now, I have been tracking the COVID-19 infection numbers. I began on March 21st, and since then have waited anxiously every day for 12:00 noon when the State of Louisiana Department of Health releases its update on the number of confirmed cases, deaths, and number of severe cases (requiring hospitalization). Initially, the data was very erratic (volatile) where one day the numbers would surge and the next would show a slower growth.

Models Are No Better Than Weather Forecasts

To say, “This is a very fluid environment”, would be a tremendous understatement. However, to go on to state, “This is will be worse than 2008” would be an equal overstatement. The reality is, we do not

have any information that can guide during an event like this. The Models, today, are no better than a weather forecast in rapidly changing weather conditions.

Models Are Not Predictions, But They Offer Guidance

As a part of my research related to this unprecedented worldwide event, I have been reviewing information from our research firm and investment product vendors. This effort is designed to gain a view of the consensus themes and an idea of where the markets might go from here.

This Too, Shall Pass

Let’s simply admit this pandemic is worse than expected. That is not to say it is the end of the world. As a New Orleanian, I remember the day after Katrina when we recognized the hurricane had not destroyed the city, but then the water started coming in and rising.

Making Sense of the Market

The title above seems silly at first. How can you make sense of this market? But, when you think about the current actions taking place, market reaction makes perfect sense.