By: Ralph C. Freibert III, Chief Investment Officer

Having worked directly with clients as well as directing the careers of hundreds of advisors during my own career, I have noticed a significant misunderstanding of the difference between investment markets and the economy. If you are one that has difficulty understanding the difference, don’t feel bad as you are certainly not alone. Many planning and investment professionals don’t truly understand the difference either.

As I mentioned in one of my most recent commentaries, while investment markets and economies are interrelated, they are not the same. And more important, the activity in each can be quite different. “Economics” is the field of study concerned with the production, consumption and transfer of wealth. (1) Whether domestic (the United States) or foreign (outside of the United States), it is simply a measure of economic activity, such as Gross Domestic Product (GDP), employment, and corporate earnings, to name three of the hundreds of thousands of economic data points. There are some counting errors that take place in the initial reporting, which comes out shortly after the end of the measuring period (month, quarter or year). It is often revised the following period, depending upon the economic reporting, due to counting errors. However, there is no predicting in economic data, that is done in economic modeling where the estimating and guessing takes place.

A great example of one of the most significant economic reports is U.S. GDP. Since it is the U.S., we consider it “domestic” (local), and it is reported quarterly. The previous report was for the 4th quarter of 2019 and it was released on January 30th of this year. The next will come out tomorrow on April 29th and will report total production in the United States for the first quarter of 2020 (January-March). Don’t expect it to be good! GDP reports the total value of goods produced and services provided during the period. That is every can of corn, car, investment fee and financial plan to name just a few of the millions of products and services produced or provided in the United States. They do not add each one, but use a representative sample to estimate the number, which is why there are some estimating errors that get adjusted as true information is collected over the following quarter. But, in the end is simply a real number.

The Market is a term used to describe a place to trade specific goods and services. When I am asked, “How did the market do today?” I often want to reply, “Which one?” That is because there is no “one” market. There are millions of markets around the world. When people go shopping, they say, “I’m going to the market”. But I know when I am asked the question, they mean the stock market and most specifically the Dow Jones Industrial Average, which is one of the three major indices (Dow, S&P, NASDAQ), and aren’t even a market. The New York Stock Exchange (NYSE) is the largest stock market in the world, but there are thousands of different investment markets across all continents. Some are crowded and some are made up of just a few participants, and we call the crowded ones “liquid” and the not so crowded “illiquid”. If there are lots of buyers, it is easier to come up with a price that is fair. However, if there are only a few potential buyers, the value is not so easily determined. One great example of this is your home.

Your home is an asset in an illiquid market. There are potentially a limited number of buyers for your home, because there are limited people who want to buy a home in your neighborhood, on your street, at the size, design, and various amenities that you believe are the most beautiful, but others think, “I really didn’t like that counter-top”. The value of your home would swing wildly if you were forced to price it every day based upon what people were willing to pay for it each day. But the good news is we don’t value our home every day. Even an appraisal is only a loose estimate of the value of your home. You won’t know what your home is truly worth until you sell it and have the money in your bank account.

The stock markets are different. Most are made up of millions of potential buyers and that has greatly expanded since I began my career. When I started my career in July of 1987, if an individual wanted to buy stock they had to go to a broker and place an order, which would be combined with other clients wanting to buy the same stock and a trader would actually go to the floor of the exchange and place the order on behalf of the clients. Today, with the tremendous connectivity created by personal computers and the internet, anyone can open an account and buy stock within seconds, even fractions of seconds (called nanoseconds), and that has been a game changer for markets having brought more buyers in. Even your home market has been expanded with the internet, because placing your ad on a page of a website allows buyers to search thousands of homes quickly to narrow down the ones, they think are nice. Just a decade ago, unless you drove around town with a real estate agent, you couldn’t see a home and home buying took a lot of time. Your search was limited by the time and patience you had and often was selected from a smaller group of potential properties.

So, while markets are tied to the economic activity, they are not a true reflection of that economic activity because of this very interesting creature called “human”. Human behavior is the thing that separates economics from market prices.

Those who have studied economics know the underlying assumption in all economic theory is “assume all participants are rational and make rational decisions”. I don’t know about you, but in my fifty-five years of life, I have met very few rational people. A rational person doesn’t say, “I don’t care, I am going to do it anyway”. That refers to buying in any area, even rocks (recall the “Pet Rock”). A rational person would not buy a Lexus over a Toyota Camry. Both cars serve the same purpose of transferring passengers from one place to another and they are even made by the same company. For those who did not know, Lexus is Toyota, Infinity is Nissan, Acura is Honda, and Genesis is Hyundai. But, how they do decide is a matter of taste and the resources of the individual. The same goes in the investment markets. IBM, Apple and Microsoft all publish software and make computers. They sell them in the same markets. However, their stock acts very differently in the investment markets because we are not looking at what the company did, but more so what we think it will do into the future. In many ways, that is a guess. Educated? Yes! But a guess, nonetheless.

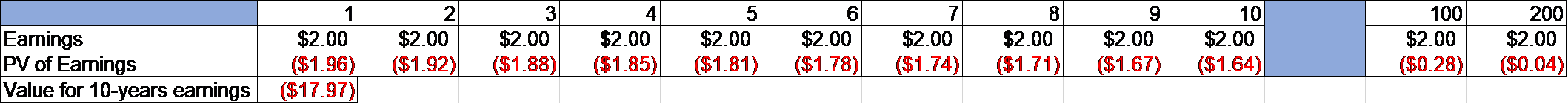

Benjamin Graham, the father of what is today know as Security Analysis and the mentor of Warren Buffett, wrote the first book on the subject aptly titled “Security Analysis” and it is still the foundation of what analysists do today. In his book, Graham describes the value of a stock as simply a present value (PV) sum of the earnings of a company. If a company earns two dollars per share this year and the subsequent years, then I can simply add up the PV of each year of earnings and that is what the value of the stock is worth.

The example above shows the present value of $2.00 received at the end of each year going out 10 years. As you can see, the further you go the less impact to the price. We get this by simply applying an interest rate and saying “what is a dollar received years in the future worth today”. For most of us older folks, a great example of this is U.S. Savings Bonds in which an individual is purchasing $50 in the future for $25 today. At a specific interest rate, they are equal in value. I know that is sometimes mindbender for most. It was for me as well in 1983 as I sat in Finance 1000 at the University of New Orleans. Thankfully, I figured it out before the test.

However, this math gets a little more complicated when we start factoring growing earnings, changing interest rates, and other factors in the economy such as supply of money and human patterns of buying. That is why it is difficult to forecast with any real accuracy and every attempt to do so is simply making educated guesses.

I know many people who are quite skilled in the practice of forecasting and today we have so many forms of data collection to aid in the process. However, those who are very skilled are often wrong and unfortunately you don’t know which ones until the future becomes the past. So you might ask, “if you don’t believe forecasting works, why bother”. The simple answer is “because my job is to understand what the markets are doing and attempt to act accordingly on a client’s behalf as it relates to their long-term goals and short-term needs”. I also am fascinated by human behavior and market reaction. I have been so since the beginning of my career. I studied psychology for this very reason.

If you are wondering, “with everything going on in the world right now, why is the market continuing to go up?” You can only answer that question by studying the current behavior of market participants, the people buying stock, and for what reason. Some are doing so because despite all of this, they are still earning income, and they are contributing to their retirement accounts. Some are doing so because they have money to use at a future date and stocks are paying more than bonds (dividends vs interest). Some are speculating, buying because they think the market will go up in the near future, and some are merely looking past the virus to a time when things will get back to normal, which is basically my view.

However, the economy is damaged, there is no question about that. People are staying home and not spending money the way they did before. Millions of Americans are out of work (26 million and counting) to be a bit more specific. (2) There are approximately 330 million people in the United States, but since not all are of working age, some too young or too old, and many have inability to work due to impairment or disability, you don’t count them all in the employment numbers. (3) As of 2019, there were approximately 157 million people working in the U.S. So the current unemployment rate is approaching 20-percent which is the highest since the Great Depression and many will not be going back to work soon.

This commentary is not meant to scare anyone. In fact, “count yourself among the lucky ones”. Most have jobs that will continue into the future. Andrew and I are also blessed in this way. But waiters will not be in high demand, nor will kitchen workers, bartenders, hospitality workers, or jobs related to travel. How bad this gets depends upon us and our spirit of caring and sharing.

Many people work in community service charities in retirement. Personally, I know a number of you reading this currently do so and so do I. All of us will see people never before in a position of needing assistance. Many of these people do not participate in the markets so that will not necessarily impact them, but many do and will be pulling money out of the market to help themselves and perhaps others. I do not expect to see tremendous growth in the equity markets, but stocks are still paying dividends and I expect they will continue to do so. That alone will likely prop up the markets in the near future. However, this is not the time to throw caution to the wind. We will remain disciplined during this process and also continue to pray that our collective efforts will get us through this new crisis. I certainly believe it will.

(1) “Economics”, retrieved April 15, 2020 from Oxford dictionary www.oed.com

(2) https://www.politico.com/news/2020/04/23/coronavirus-unemployment-claims-numbers-203455

This commentary reflects the personal opinions, viewpoints and analyses of Planning Associates Wealth Management, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Planning Associates Wealth Management, LLC or performance returns of any Planning Associates Wealth Management, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Planning Associates Wealth Management, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Recent Comments