By: Ralph C. Freibert III, Chief Investment Officer

When people ask, “How did the market do today? They are typically referring to the Dow Jones Industrial Average (The Dow), which is the oldest and most quoted index. But, did you know there is a Dow Jones Transportation Average? And, did you know The Dow is made up of only 30 stocks of the over 3600 traded stocks in the United States, alone. Additionally, those 30 stocks have changed many times though company mergers, failures, and simply falling out of prominence. “The Dow was created in 1896 by Charles Dow and originally consisted of 12 companies: American Cotton Oil, American Sugar, American Tobacco, Chicago Gas, Distilling & Cattle Feeding, General Electric, Laclede Gas, National Lead, North American, Tennessee Coal and Iron, U.S. Leather and U.S. Rubber”.[1]

Many of those companies do not even exist today. So, what happens when a company is dropped, goes out of business, splits, or merges? The index proprietors (Dow Jones Incorporated) use a mathematical divisor that is adjusted each time to keep the index value neutral to the change. This means, not only is the Dow just a very small representation of stocks at less than one percent of the total U.S. exchange traded stocks, but it is also an irrelevant number because of the many changes that have taken place to the divisor since 1896. If you add up the value of all 30 stocks, it doesn’t sum to 24,465 which was the close on Friday, May 22nd. In relative terms, the Dow is about as good a reference for the stock market as U.S. employment. It is related but does not tell you much about the markets as a whole.

The question is, “Why is it so recognized and quoted?” The answer is simple, it is the most familiar and the largest number. People like big numbers verses small numbers. I don’t know why, but they do. It sounds so much better to say, “The Dow was up 300 points today” verses “The S&P was up 35.69 points”. On a percentage basis, they sound very different, don’t they? But essentially, they are the same change on a percentage basis. However, to say the S&P was up 35.69 is in many ways a better indicator than the Dow because the S&P is made up of 500 stocks, not just 30.

But, even the S&P (Standard and Poor’s 500) is only 500, “selected” stocks. They are not the five-hundred largest stocks, nor the five-hundred best stocks. They are simply the ones that Standard and Poor’s selected to represent the stock market. They created a new index they felt was a better representation of the market than the 30 industrial stocks chosen by Dow Jones. But then came the Russell 1000[2], Russell 3000[3], the FTSE[4], …

Today, there are hundreds of market indices that cover every possible area of investing. I’m thinking of creating the Freibert 500. I think it sounds kind of catchy, but not sure yet what 500 investments to choose. Perhaps it will be 500 stocks randomly chosen by dart, daily. It will be unique, constantly changing and will require some math each day. I love doing math!!! However, the only way it will catch on is if I create a high quality You-Tube video with music and a gimmick to catch the attention of millennials.

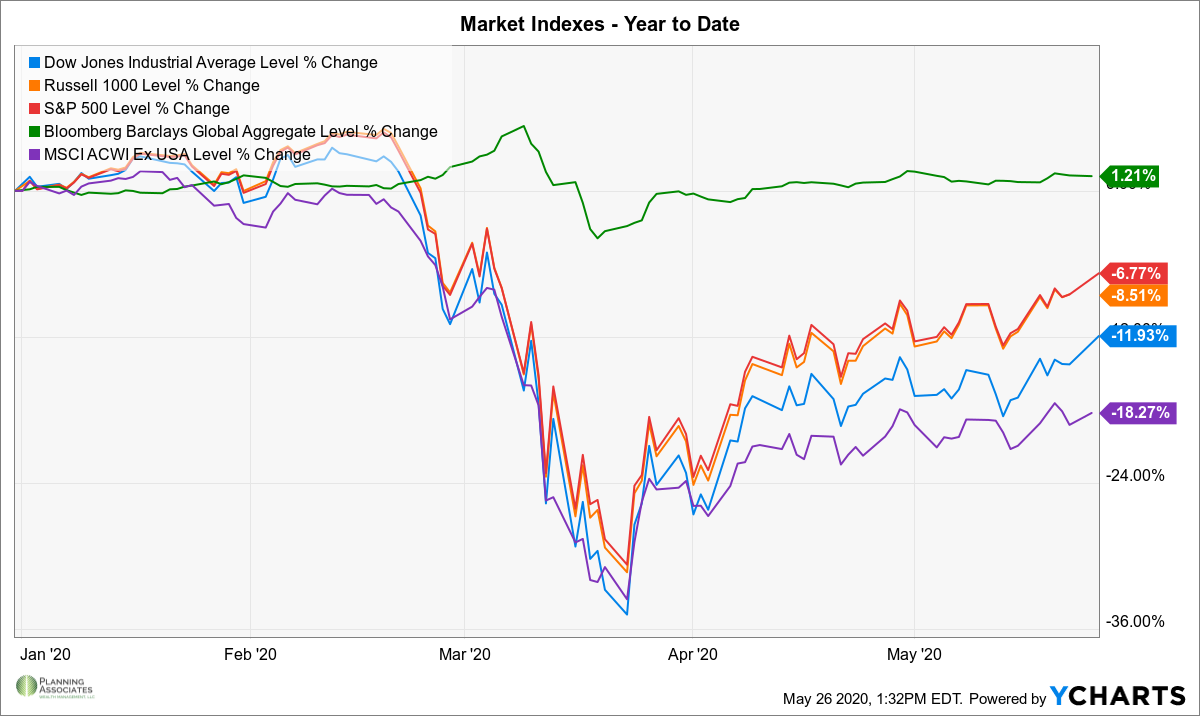

Seriously, indexes are a dime a dozen and many are not used by most investment professionals. However, many are good representations of the underlying markets. I use the S&P 500, Russell 1000, Russell 3000, FTSE, and MSCI World ex US[5], to provide me with information about how the equity (stock) markets are doing. I also use the Barclays Aggregate Bond Index, The Agg, for the bond market along with closely monitoring the Treasury rates at different maturities. I also use short-term corporate and municipal indices and the intermediate-long corporate municipal indices. Because of the greater variability in types of bonds, you need to use more than one index to get a good feel for markets. One final note, when we talk about markets, we are typically talking about markets that trade listed securities, like the NYSE, NASDAQ, corporate bond markets, traded US Treasury bonds. There are many markets that do not trade on a true exchange or large group of people, called desks. Those that do not trade easily are called illiquid or “thin” markets. Your home is an illiquid market and that treadmill you have been trying to sell on eBay is a thin market.

From all of the listed and liquid markets and indices, we can get a pretty good idea of how the markets are reacting. We can use this information to determine what areas are getting a bit overpriced and underpriced as well as what areas of the market look more or less attractive.

Just because something looks cheap or expensive does not mean it won’t become cheaper or more expensive. That is why investing eludes the skill of millions of professional and individual investors. What is the most entertaining to me is when a client or other professional says, “I did so well with that pick of XYZ company”. I just grin and think, “Yeah, better to be lucky than good”. By the way, I do the same in the mirror, as I fall prey to feeling good about my decisions when they are good and bad when they are not so good. I find it hard to bring myself to say, “bad decision” at times.

Sometimes, the best decisions are the ones you didn’t make. Like the time you were at that Christmas party and your relative who is on his third cocktail begins offering their unsolicited investment advice and begins bragging about how well their portfolio is doing. Part of you doesn’t want to miss out on an opportunity, especially one that someone else will win on and you will miss out on. But remember, when it comes to investing, cooler heads usually prevail regardless of what your over-served relative thinks.

The reality is there is no holy grail of investing except to invest consistently over time. Do not panic in a crisis and do not bet your life savings on a “sure thing”. There will be opportunities that present themselves and you should take advantage of those opportunities. However, this event is not one of them. There are too many variables in the market today and we have no playbook for a total shutdown of the world economies. No production means no revenue. No revenue, no profits. No profits, no growth. That is as simple as it gets. It is also not time to panic as the world’s central banking systems are injecting trillions of dollars into the hands of individuals and businesses in the form of the stimulus checks, PPP loans and loans to large business.

The one thing about the markets that I do feel confident about is that they will recover over time. If you are young, then this is a great time to keep adding to your 401(k). If you can increase by a couple percentage points, this is a great time to do so! For older clients, be thankful that we insist on three to six months of emergency reserves and keep at least 3 years of income in maturing bonds. That is not a guarantee in any way, but it sure will help get you through the next 3 to 5 years. When considering variables, one is the length in which it make take our economy to recover from this global shutdown. One thing that isn’t a variable is whether it will recover, that it will. Humanity is resilient and has found a way to overcome much worse in our history.

Finally, if you are thinking you missed a great opportunity with the market is up 30% since March 23rd, I challenge you to consider your revisit your feelings from that day. Let’s go back to that day and remind you that since the previous Monday, the market saw daily decreases of 12.9%, 6.3%, 4.5% and 3.0% that included a temporary halt in trading due to a circuit breaker trigger. Buying equities that day would have been a guess and would have been correct. But the stimulus checks have not been spent yet and the foreclosures have not hit the paper. There are many things to come as you will be hearing more and more about bankruptcies, unemployment, and foreclosures in the months and years to come. There is a popular quote that reads “a recession is when your neighbor losses his job, but a depression is when you do”. I am not in a depression yet and I suspect most of you are not yet either. However, there are many people already depressed and we need to be considerate and pray for them every day.

[1] Sourced from Investopedia, May 21, 2020, “Who Were the Original Dow Jones Industrial Average (DJIA) Companies?”

[2] The Russell 1000 Index is a stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 90% of the total market capitalization of that index. Wikipedia.com, May 21, 2020

[3] The Russell 3000 Index is a capitalization-weighted stock market index, maintained by FTSE Russell, that seeks to be a benchmark of the entire U.S stock market. Wikipedia.com; May 21, 2020

[4] Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the “Footsie” /ˈfʊtsi/, is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization, Wikipedia.com, May 21, 2020.

[5] The Morgan Stanley Capital International All Country World Index Ex-U.S. (MSCI ACWI Ex-U.S.) is a market-capitalization-weighted index maintained by Morgan Stanley Capital International (MSCI), Wikipedia.com, May 21, 2020.

This commentary reflects the personal opinions, viewpoints and analyses of Planning Associates Wealth Management, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Planning Associates Wealth Management, LLC or performance returns of any Planning Associates Wealth Management, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Planning Associates Wealth Management, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Recent Comments