By: Ralph C. Freibert III, Investment Advisor Representative

For most New Orleanians, the last week of October was more about hurricane preparedness and clean-up. If like Andrew and me, you also were living with no power and adapting to a more rustic way of life. I mentioned to my wife in mid-summer, “I’d like to do a little camping this fall”. Laying on a camping cot next to my pool on Wednesday evening after the hurricane had passed, I had to chuckle a bit, “not really what I had in mind, Lord”. The following week, we had Election Day that many had been expecting for a very long time, regardless of your political tilt. The outcome is still in question, though likely resolved.

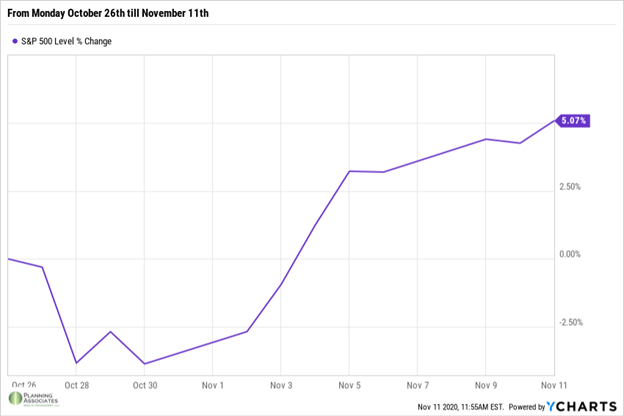

However, if you look at the chart shown below, you can see that while we were consumed with hurricanes and elections, the domestic stock market (represented here by the S&P 500) was taking quite a ride. No, it wasn’t the worst volatility nor was it the best gains recorded, but it has been dramatic on both sides.

Hopefully, you have come to expect wide swings in the market in times of uncertainty and discourse. If so, then you have truly moved into a new classification of investor who remains calm and keeps their eyes on the long-term picture. However, it is also important to not get excited when we see these run-ups in the market, either. It is easy to look at the market with our own personal narrative and say, “This is a great time to invest, because…”. First and foremost, it is always a great time to invest in something, but if you believe you have that special gift blessed by God to choose the correct asset at the correct time, this article may not be for you.

After thirty-five years of study and practice, and working with many investment management professionals and academicians, I have not found one that has found “the secret”. Sure, I know many that do a very good job managing investments and investment portfolios, we believe we are among them. Some managers have exceeded market averages over a long period of time, but when that time passes they are no better than the average. Unfortunately, you just “cannot know the day and time” the best and worst periods are over. Also, without a tried and true process, they are doing nothing more than betting with other people’s money. Long-Term Capital Management [1] is a very dramatic example of this, as is the collapse of the housing market and sub-prime mortgages. Also, who can forget the Dot Com Bubble! These events cost investors billions each occurrence and for those who thought they had found the keys to investment success and placed more and more money into the market, they lost most if not all.

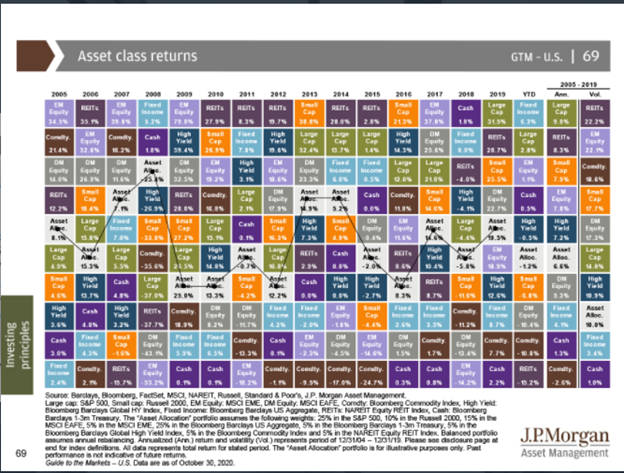

The chart above taken from the J.P. Morgan Asset Management’s “Guide to the Markets”, shows just how unpredictable asset returns can be. It goes back to 2005 and shows how dramatically markets can change. In 2005, 2006 and 2007, Emerging Market Equity (EM Equity) was up over 30-percent each year and real estate investment trusts provided strong returns as well in ’05 and ’06, but look how quickly those returns turned negative.

Mark Twain once stated, “put your eggs all in one basket and then watch that basket”. He was famous for entertaining phrases. However, that might work for eggs, but I can assure you it is useless for asset management. Even if you put your money in the bank, guaranteed by the Federal Deposit Insurance Corporation (FDIC), inflation is taking an unseen bite out of your account each year.

If, for some reason, the market climbs or falls as a result of the recent election, it has nothing to do with the person occupying the Oval Office, it is simply part of the general economic and market cycles. As our economic consultant, Ed Yardini, stated recently, “Presidents don’t employ people, businesses do”. More important is congressional policy making and the stated goals of the two parties vying for control. Depending upon your political philosophy, the remaining congressional seats up for grabs are critical to further a liberal agenda of redistribution of wealth or slow a dramatic move in that direction. We will leave our personal political opinions out of the investment management work we do, but these policies have a much greater impact upon businesses and their growth. Even the Great Depression was much more about control of the money supply and actions taken by the Congress, then simply the market crash[2].

We employ a very specific method of investment management that is based upon the achievement of goals, and a specific rate of return is not one of them. We believe returns are random (unpredictable) and most of the academic community supports this thesis. Investment managers who earn their living by managing assets vie for investment dollars by coming up with “the next great thing”. But we do not attempt to win favor by telling people something we think they want to hear to win the business only to disappoint later. A person who wants to retire at age 67 can reach their goals by earning 5-percent on average, as well as 7-percent on average. Sure, one makes the goal a lot easier, but that cannot be predicted nor expected.

The key is to diversify assets based upon your goals and emotional risk comfort, invest regularly over time, and review your investments at stated intervals to make sure one asset is not dominating the total portfolio due to market growth or declines. Sure, there are several ways to invest, but we feel strongly that those basic principles are vital to an investors success which is reaching their stated goal. We feel that without utilizing sound principles of investing, though you might reach your goals through pure luck, as I always say, “hope is not a strategy”. I’m sure I didn’t make that up, but I cannot remember where I heard it.

It is my belief that politics are politics and investing is investing. One does have an influence on the other and depending upon your beliefs, you should certainly support the candidates you believe will represent you, not their own self-interest. So, I will take the famous Mark Twain quote and apply my own literary license, “choose the candidate you believe best represents your interests and watch him/her carefully”. If you do that, then businesses will do their part to employ, produce, distribute effectively, and grow, and so will your investment assets.

[1] “The Story of Long-Term Capital Management”, by Philppe Jorion, Canadian Investment Review, Winter 1999

[2] “Predicting the Markets”, by Edward Yardeni, YRI Press, 2018

This commentary reflects the personal opinions, viewpoints and analyses of Planning Associates Wealth Management, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Planning Associates Wealth Management, LLC or performance returns of any Planning Associates Wealth Management, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Planning Associates Wealth Management, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Recent Comments