Market Commentary

Market Commentary – Week Ending September 12, 2025 Markets delivered another solid week of performance, with major indices extending their summer gains. Technology and Communication Services remained leadership sectors, while Industrials and Financials provided...

Market Minute- Full Report: August 2025

Equity Markets August carried forward the strong second-quarter results, with the Russell 3000 up nearly 11% in Q2, driven by technology (+23.5%), communication services (+19%), and industrials (+13.6%). Market gains remained concentrated in a few names—NVIDIA,...

Market Minute – What’s Bad is Good

By: Andrew B. Noto It feels like bad news has been good news to investors lately. We opened the month of October last week with two consecutive days of positive returns. Monday’s catalyst was investors thinking the Federal Open Market Committee’s (FOMC) tightening...

Remember the Long Game

By: Andrew B. Noto Last Friday wrapped up a September that equity investors would like to forget. The S&P 500, Russell 3000, and Dow Jones Industrial Average all retreated greater than 9% for the month. August’s CPI data earlier in the month started the selling....

Fed Week Recap

By: Andrew B. Noto It was quite an eventful week. A week that was likely dictated by the actions of the Federal Open Market Committee and the words of its chairman Jerome Powell. At today’s close, the Dow Jones Industrial Average, S&P 500, and Russell 3000 all...

Market Minute – Inflation Report Shocks Investors

By: Andrew B. Noto Today started with news that the August consumer price index (CPI) report came in higher than expected and ended with aggressive selling in most major equity markets. When the trading day concluded, all thirty companies in the Dow Jones Industrial...

Market Minute – Some Minor Anguish in August

By: Andrew B. Noto With the closing bell this afternoon, the S&P 500, Dow Jones Industrial Average, and Russell 3000 indices all ended the month in negative territory after a roaring start. Halfway through the month, it looked like we were on track for another...

Not What We Hoped But Not Different Than Expected

By: Ralph C. Freibert III, Chief Investment Officer Last week’s CPI release was a bit of a disappointment. Almost 1-percent month-over-month (MoM), and 8.58-percent year-over-year (YoY). Economists were hoping for signs that inflation had peaked back in March at...

We are Back and So is Inflation

By: Ralph C. Freibert III, Investment Advisor RepresentativeIt has been a while since I have written a commentary on the markets. This was due to several factors, including: the birth of our first grandson, sending our youngest son off to Army Basic Combat Training,...

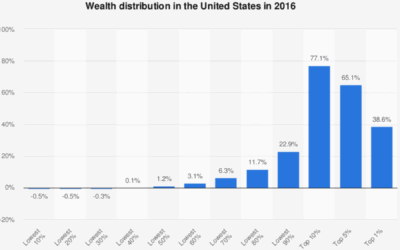

If You Don’t Get Investing, Blame it on Evolution

By: Ralph C. Freibert, III, MBA, CLU®, CLTC®, CIMA®, CFP®, Investment Advisor RepresentativeEver wonder why so few succeed in wealth creation? Seventy-seven percent of the wealth in the United States is owned by just 10-percent of the population (see table below)....

More than Meets the Eye

By: Ralph C. Freibert III, Investment Advisor Representative For most New Orleanians, the last week of October was more about hurricane preparedness and clean-up. If like Andrew and me, you also were living with no power and adapting to a more rustic way of life. I...

Uncertainty Equals Volatility

By: Andrew B. Noto, Investment Advisor RepresentativeIf there is one thing that has been apparent in 2020 it is that the stock market does not like uncertainty. The S&P 500 closed down 64 points today after a late afternoon rally of 36 points, a daily decline of...

One Year and Counting

By: Andrew B. Noto, Chief Executive OfficerEarlier this month marked one year since Planning Associates Wealth Management, LLC became a registered investment advisory firm with the Securities and Exchange Commission (SEC). Though the milestone came with no fanfare,...

Prudence and Patience are Virtues

By: Ralph C. Freibert III, Investment Advisor RepresentativeIf there is one thing I have learned in my 30-plus years as a student and professional in investment management it is “investment returns are random”. Many interpret that statement the following way. ...

Understanding Markets

When people ask, “How did the market do today? They are typically referring to the Dow Jones Industrial Average (The Dow), which is the oldest and most quoted index. But, did you know there is a Dow Jones Transportation Average? And, did you know The Dow is made up of only 30 stocks of the over 3600 traded stocks in the United States, alone. Additionally, those 30 stocks have changed many times though company mergers, failures, and simply falling out of prominence.

Why Diversification Works

As an advisor, it is sometimes a difficult to explain to a client why their assets are not keeping up with the popular, broad-based market indices such as the S&P 500 or the Dow Jones Industrial Average. The correct answer most of the time is because the comparison being made is inappropriate.

What’s Up With This Market? Economy vs. Markets

Having worked directly with clients as well as directing the careers of hundreds of advisors during my own career, I have noticed a significant misunderstanding of the difference between investment markets and the economy. If you are one that has difficulty understanding the difference, don’t feel bad as you are certainly not alone. Many planning and investment professionals don’t truly understand the difference either.

Sorry to Get So Technical

Last week ended with the S&P 500 up almost 25%1 closing at 2789.82 on Thursday, the largest weekly gain in 46 years! There is no doubt that my expectation of “higher volatility” presented at our Outlook event back in early February has turned out to ring true, but the reason for the volatility wasn’t even a thought at the time for most of the nation.

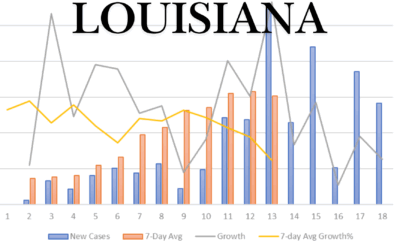

The Trend is Our Friend

For weeks now, I have been tracking the COVID-19 infection numbers. I began on March 21st, and since then have waited anxiously every day for 12:00 noon when the State of Louisiana Department of Health releases its update on the number of confirmed cases, deaths, and number of severe cases (requiring hospitalization). Initially, the data was very erratic (volatile) where one day the numbers would surge and the next would show a slower growth.

Models Are No Better Than Weather Forecasts

To say, “This is a very fluid environment”, would be a tremendous understatement. However, to go on to state, “This is will be worse than 2008” would be an equal overstatement. The reality is, we do not

have any information that can guide during an event like this. The Models, today, are no better than a weather forecast in rapidly changing weather conditions.

Models Are Not Predictions, But They Offer Guidance

As a part of my research related to this unprecedented worldwide event, I have been reviewing information from our research firm and investment product vendors. This effort is designed to gain a view of the consensus themes and an idea of where the markets might go from here.

This Too, Shall Pass

Let’s simply admit this pandemic is worse than expected. That is not to say it is the end of the world. As a New Orleanian, I remember the day after Katrina when we recognized the hurricane had not destroyed the city, but then the water started coming in and rising.

Making Sense of the Market

The title above seems silly at first. How can you make sense of this market? But, when you think about the current actions taking place, market reaction makes perfect sense.

A Bear Market is Upon Us

The panicked selling in the United States equity markets continued Wednesday as one of the major U.S. indices, the Dow Jones Industrial Average (DJIA), reached bear market territory as fears of the coronavirus intensified as the World Health Organization declared the outbreak an official global pandemic.